Machine Learning and AI for revolution of Tech Companies are changing and streamlining businesses.

The finance industry has always been at the forefront of adopting cutting-edge technologies, and Artificial Intelligence is no exception. While AI is gaining traction across various sectors, its impact on finance is particularly transformative. From enabling banks and lenders to streamline operations, to making data-driven decisions, and delivering highly personalized customer experiences, the benefits of AI in finance are undeniable.

Recent innovations in AI are pushing the boundaries even further, helping financial institutions boost efficiency, improve decision-making, and optimize service delivery. But to truly capitalize on AI’s potential, businesses must look beyond the hype. Leveraging AI development services and tailored AI solutions can unlock new levels of productivity while significantly reducing costs.

At ViitorCloud, we provide comprehensive AI solutions designed specifically for the finance industry. Our expertise can help your business harness the full power of AI to not only stay ahead of the curve but also achieve tangible results that drive success. Let’s explore how our AI services can elevate your financial operations.

READ: AI in Finance – Transforming Banking with AI Solutions

Why Does AI Matter in the Finance Sector?

Imagine being able to predict market trends or make rapid financial decisions with ease—thanks to AI, that’s exactly what financial institutions can achieve today. With the benefits of AI in finance, massive amounts of data are processed at lightning speed, enabling quicker insights and more informed decisions. At ViitorCloud, our AI solutions are designed to help finance businesses optimize their processes, from risk management to market forecasting.

One of the biggest impacts of AI in finance is its ability to detect fraud in real-time. Our AI development services provide startups and established finance companies with advanced systems that continuously learn from data patterns, identifying suspicious activities as they occur. This proactive approach not only protects your institution from threats but also fosters trust with your customers.

With AI-powered chatbots, your business can offer seamless customer service, addressing queries instantly without human intervention. But don’t worry—AI solutions don’t replace human expertise. They enhance it. While AI handles data processing and automation, your team can focus on strategic decisions that require human insight. Our AI development services offer the perfect blend of cutting-edge technology and human expertise to help your business thrive in this competitive sector.

Unlock the Benefits of AI in Finance Today

Streamline your financial operations with cutting-edge AI solutions designed to enhance efficiency and accuracy. Partner with us for tailored AI development services that empower your business to stay ahead.

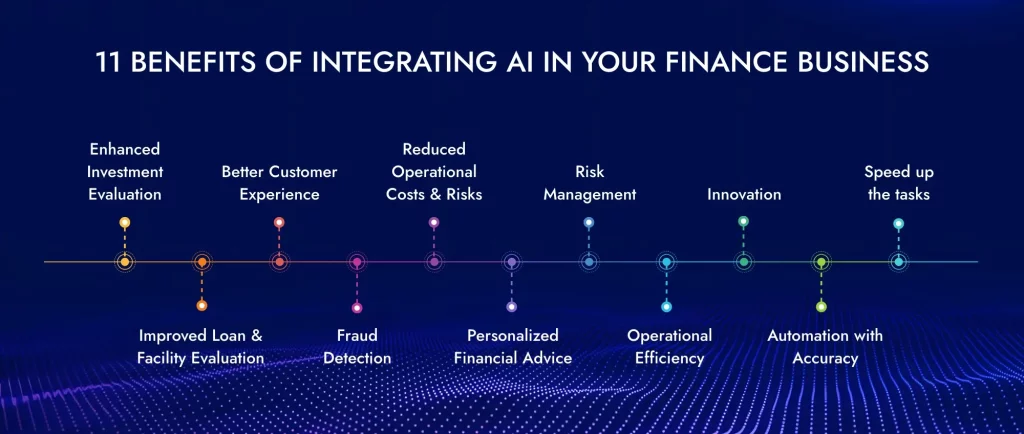

Benefits of AI in Finance Business: Integrating AI in Your Finance Business

Integration of Artificial Intelligence is an absolute game changer with many privileges.

Let us examine how the field of finance benefits from AI:

1. Enhanced Investment Evaluation

Bank profitability isn’t only about earning interest. Banks are always looking for profitable investment opportunities that maximize returns.

The role played by sophisticated investment software must be considered since it offers custom-made financial institutions risk appetite-driven advice regarding investments. Further, AI tools can accurately evaluate customer proposals that involve complex industry-specific information.

Though human analysts have the final say on investment decisions, investing analysis software makes this process easier by juggling multiple variables and scenarios. Gathering and analyzing relevant data may be time-consuming and challenging, especially for organizations entering foreign markets. In such scenarios, AI-powered software provides a quick way to assess new markets and opportunities.

2. Improved Loan and Facility Evaluation

Often, financing eligibility based solely on credit scores relies on obsolete data, mistakes or misclassifications. However, today, abundant online information can lead to more accurate assessments of individuals or businesses.

AI-driven systems can now provide endorsements or refusals based on a wider range of factors, even if there are minimal documents available from applicants. The problem still needs to be solved in understanding why the system recommended it. While approved applications usually move forward with little questioning, rejections require clear explanations on why they could not lend from institutions to clients.

According to Accenture, “banks can increase the volume of interactions or transactions by 2-5 times without needing to increase staff” by utilizing AI-based tools. Although artificial intelligence systems may feature biases incorporated in their designs, developers eventually decide on them so that they can provide some form of objectivity. Nevertheless, with growing awareness of institutional prejudices and the heterogeneous nature of funding applications, software developers are now better placed to improve applications and updates by incorporating more pertinent variables.

3. Better Customer Experience

Customers today are all about convenience. The ATM improves the banking system by enabling access to critical services even when banks are closed, which, in turn, fuels innovation in finance startups through AI. Clients can now open smartphone bank accounts and complete verification while sitting on their couches.

This can be done using Decision Management Systems (DMS) to streamline the capture of Know Your Customer (KYC) information, significantly reducing errors and turnaround times. And because the business rules software is robust enough, the banks can quickly effectuate and deploy business decisions without long-established processes.

This ensures that new products and specials are available at the right time and changes made on business decisions or tariffs are incorporated seamlessly into the system. Automated eligibility checks mean clients aren’t frustrated by lengthy processes only to be rejected. This gives personalized service while serving a large number of customers.

4. Fraud Detection

An Enterprise Decision Management System enhances early fraud detection and ensures full audit documentation. Regular third-party audits can interrupt business operations when employees leave their workplace to explain or validate transactions. Software based on advanced technology often recognizes errors through precision data captured by the system itself.

Fraud tactics change as banks tighten controls. Today’s criminals do transactions under detection thresholds so as not to raise suspicion. Without deep-rooted analysis, such activities may slip past checks into compliance even though they satisfy basic requirements. This is where artificial intelligence outperforms humans.

AI scans huge amounts of records to identify suspicious deals accurately, while human attention may go astray in such volumes. Money laundering or funding illegal activities can thus continue undetected if there are no AI-driven mechanisms to detect fraudsters taking advantage of loopholes.

5. Reduced Operational Costs and Risks

Although banking mostly runs electronically, many people-centered practices necessitate lots of paperwork; hence, these processes become major cost centers and risks that lead to errors.

Robotic process automation (RPA) is software miming rule-based digital tasks that humans usually perform. With advancements in handwriting recognition, natural language processing, and other AI technologies, RPA bots can transform into intelligent automation tools capable of handling a wide range of banking workflows once done exclusively by humans.

This implies hyper-automation which combines AI alongside RPA thereby changing effective and reliable banking systems.

6. Personalized Financial Advice

Consider receiving instant financial advice customized to your personal needs and objectives. For instance, AI algorithms can analyze various factors to provide you with customized recommendations such as your financial background, spending habits, or even investment preferences.

AI-powered robo-advisors can recommend portfolios depending on an individual’s risk tolerance levels and financial goals, thus optimizing asset allocation for enhanced returns. Such customization leads to increased client satisfaction and better financial outcomes since investments are aligned with people’s likes and aspirations.

Furthermore, AI-driven financial advice is available around the clock, providing prompt responses to financial planning, budgeting, and investment strategy queries. Thus, clients are empowered by this accessibility to make informed decisions quickly outside of the limitations of traditional banks’ hours.

7. Risk Management

It is important in finance to employ effective risk management systems to ensure financial stability and minimize potential losses. AI is very helpful in managing risks using sophisticated algorithms that can process massive volumes of data concurrently.

By processing this information, AI systems can uncover patterns indicating future risks like fraud or unusual market movements. The early identification of risks enables banks to mitigate them to safeguard assets and preserve operational continuity.

8. Operational Efficiency

Individuals can redirect their attention to strategic initiatives by using AI to handle repetitive tasks. AI excels at automating tasks such as document verification, summarization, transcription of phone conversations, and responding to common customer queries such as operational hours.

This technology allows AI bots to take over mundane or low-engagement tasks previously done by humans thus increasing efficiency and productivity across various areas. It optimizes operations while freeing up human personnel for value-added jobs that drive innovation at the organizational level.

9. Innovation

AI drives innovation in finance, leading to radical changes in different industries. This ranges from improved customer experiences to optimized operational efficiencies; traditional banking is being redefined through the application of AI technologies that are also opening up new growth and development opportunities.

AI has enabled predictive analytics and forecasting models as another area where innovation occurs. Market behavior, asset performance as well as demands from consumers can all be accurately predicted using AI programs based on historical data together with real-time market trends.

In addition, startups spearheading Blockchain technology and smart contract applications have transformed finance Startups with AI which has made finance more transparent, secure, and efficient among others

10. Automation with Accuracy

Repetitive and time-consuming tasks have been transformed in financial institutions by AI-driven automation through increased precision. Document verification, compliance checks, and transaction processing are some of the complex processes that can be done swiftly and without any mistakes by AI-based automated systems.

Using machine learning algorithms, these systems can learn from past interactions and improve performance, ensuring consistent data handling and decision-making accuracy.

For instance, AI-based robotic process automation (RPA) bots can automate back-office operations like data entry and reconciliation, significantly reducing the manual effort required and minimizing the risk of human error.

11. Speed Up the Tasks

Speed is a critical advantage AI brings to finance, where timely decision-making and quick responses can make a significant difference. AI for finance startups accelerates tasks across various domains, from customer service to data analysis, enabling financial institutions to meet the growing demands for faster service delivery and operational responsiveness.

In customer service, AI-powered chatbots and virtual assistants respond instantly to customer inquiries 24/7. These bots can understand natural language, interpret queries, and promptly deliver accurate information or resolve issues.

Transform Your Finance Strategy with AI

Discover the full potential of the benefits of AI in finance. Our expert AI development services deliver innovative AI solutions that elevate performance and drive growth.

How does ViitorCloud Overcome Finance Challenges With an AI Solution?

AI solutions for finance present a game-changing opportunity for businesses in the financial sector. By streamlining operations, enhancing decision-making, and delivering personalized customer experiences, the benefits of AI in finance are undeniable.

With ViitorCloud’s AI development services, your financial institution can automate routine tasks like data entry and fraud detection, optimize investment strategies, and strengthen risk management. Our AI solutions not only help you stay ahead of the competition but also empower you to overcome complex industry challenges with ease.

Partner with ViitorCloud today to harness the full potential of AI and unlock new opportunities for growth in your financial operations. Let’s take your business to the next level!

Benefits of AI in Finance

Frequently Asked Questions

An example of AI in finance is AI-powered chatbots that handle customer inquiries and transactions, providing 24/7 service without human intervention.

AI is used in finance for fraud detection, risk assessment, automated trading, and customer service, enhancing efficiency and accuracy.

AI helps finance companies by improving decision-making with data-driven insights, automating repetitive tasks, and enhancing customer experiences through personalized services.