Machine Learning and AI for revolution of Tech Companies are changing and streamlining businesses.

AI technologies have transformed the BFSI sector, impacting millions of lives globally by providing 24/7 access to accounts, seamless customer support, and smoother operations. With ViitorCloud’s AI finance solutions, your business can benefit from the power of AI to optimize efficiency and elevate customer experiences.

One of the key advantages of AI is its ability to analyze vast amounts of data in real-time. This capability allows financial organizations to identify patterns, predict market trends, and make informed decisions that drive business growth. Whether it’s fraud detection, risk management, or personalized financial advice, AI use cases in finance continue to unlock immense value for both banks and customers alike.

At ViitorCloud, we specialize in delivering AI development services tailored to the unique needs of financial institutions. Our AI-powered tools enhance operational efficiency, improve decision-making, and ensure smooth transactions, positioning your business to stay ahead of the competition. Whether you’re looking to streamline customer interactions, optimize financial processes, or safeguard against cybersecurity threats, our AI solutions can help you navigate the complexities of today’s financial landscape.

Explore how we can drive your business forward with cutting-edge AI finance solutions in the following blog. We focus on practical, scalable implementations that deliver measurable results, ensuring that your finance operations run efficiently and effectively.

READ: Benefits of AI in Finance: Transforming Financial Services

Why Finance Companies are Turning Into AI

The financial sector is at a point of change due to the development of artificial intelligence technologies, which are opening new avenues for value creation. However, distinguishing between temporary trends and sustainable AI use cases in finance can be challenging, with the market buzzing with AI advancements.

Nevertheless, according to Nvidia, 91% of financial companies report improvements from implementing AI. In simpler terms, machine learning (ML) and deep learning (DL) are making financial companies more profitable and helping them capture a larger market share. Many industry players are increasing the deployment of AI-powered applications. In 2023, 43% plan to continue investing in AI/ML and 42% in advanced predictive analytics, as per OneStream. AI drives a new generation of customer-facing products like personal finance use case apps, robot advisors, and lending tools.

For instance, RBC recently launched NOMI, an AI-powered personal financial management app described by 53% of users as a “powerful weapon” for their budgeting purposes. On the back end, AI in finance helps employees in finance services with intelligent process automation, advanced financial analytics, next-best-action recommendations, automated account reconciliation, and risk management. Such as JP Morgan Chase implemented an ML-powered platform for compliance management saving about 360k hours annually by its legal and lending teams. Through implementing AI in FinTech organizations can achieve four major results: higher profits; at-scale personalization; distinctive omnichannel experiences; and faster product innovation.

ALSO READ: Top Applications of AI in Finance Transforming the Industry

Uncover the Potential of AI Use Cases in Finance!

Leverage AI to improve your financial operations, minimize risk, and foster innovation. ViitorCloud’s AI Development Services can revolutionize your Banking, Financial Services, and Insurance business.

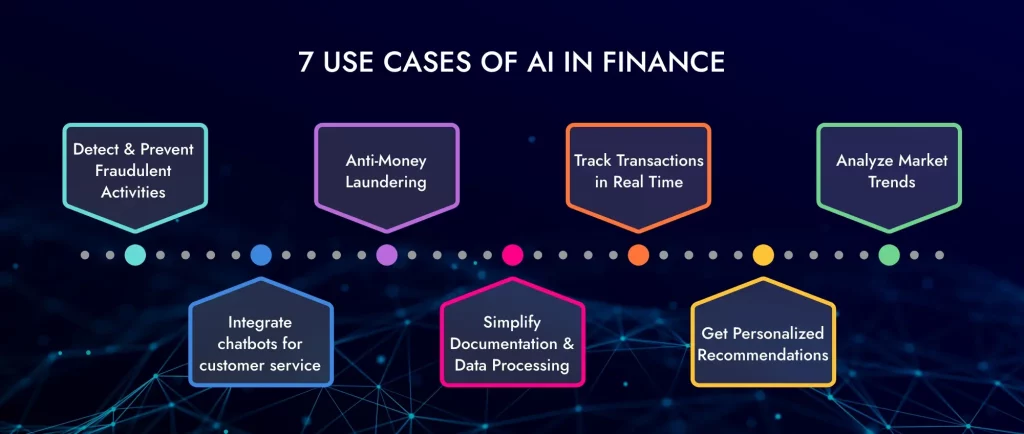

7 Innovative AI Use Cases in Finance

We provide you with insights into key market trends, helping you to concentrate your efforts on those areas where they will be most effective on AI use cases in finance. Learn how our AI solution can transform front-office (customer-facing) processes and back-end operations, making you the number one player in this market.

1. Detect and Prevent Fraudulent Activities

Traditional rule-based systems for fraud detection cannot keep pace with the growing volumes or increasing variety of transactions that need to be checked. These systems programmed by humans often result in high false positive rates, which causes users’ payments to decline in frustration. Consequently, merchants with high card decline rates switch payment service providers (PSPs) so that 33% of consumers won’t shop again with a business after a false decline.

In contrast, AI-powered fraud detection algorithms keep learning from transaction patterns and get better at distinguishing between genuine ones and fraudulent activities. For instance, Stripe Radar assesses over 1,000 transaction characteristics in seconds to gauge its likelihood of being fraudulent. This AI use case in finance systems evolves continually, thanks to its deep neural network (DNN) architecture, which can be re-trained in under two hours with new insights from all Stripe transactions.

For instance, as more than 90% of cards on the Stripe network were used more than once, it enables Stripe to make better decisions and reduce false positives. Thus only 0.1% of legitimate transactions are wrongly blocked by Stripe Radar. Looking at the payments sector’s hyper-growth rate, one can easily see how an investment in our solution for AI-based fraud detection pays off quickly as it minimizes financial losses while enhancing merchant satisfaction.

2. Integrate chatbots for customer service

Customer service is crucial for business success but satisfying diverse customer needs might be time-consuming and expensive. This is where our solution of Generative AI-driven chatbots comes into play. Generative AI-powered chatbots simulate natural human-like conversations allowing customers to instantly talk to them around the clock. Unlike simple rule-based systems, these bots comprehend context, sentiment, and language subtleties leading to smooth personalized interactions.

The generative model we build into the chatbot analyzes queries made by customers using generative AI before providing relevant responses or solutions they may require. These chatbots perform various tasks such as checking account balances, explaining transaction details, or assisting with account setup allowing human agents to deal with more complicated questions when asked by your clients.

Banks can improve customer satisfaction using generative AI-driven chatbots that we develop according to your needs and offer non-stop assistance to your customers. Moreover, these robots cut operational expenses while increasing response time. Furthermore, chatbots accumulate valuable data on customers and help the banks gain a better understanding of their clients and customize services based on customer’s needs. By focusing on improving overall customer experiences while driving operational efficiencies, our generative AI-powered chatbot solutions are transforming service delivery in banking.

3. Anti-Money Laundering

The highest concern of banks is to prevent money laundering and meet regulatory obligations. Combining with Generative AI, it has proved to be an influential tool in enhancing Anti-Money Laundering (AML) practices. Additionally, huge transaction datasets, consumer profiles, and historical patterns can be analyzed by generative AI models. These models can identify known money laundering methods and new, evolving schemes, helping banks stay ahead of criminals.

What makes Generative AI especially effective in AML is its ability to create predictive models that detect anomalies and patterns that suggest money laundering. These models learn from new data, allowing them to adapt to new threats.

For banks, using generative AI in AML means more accurate detection of illegal activities, fewer false positives, and better compliance with regulations. This helps banks protect their reputation, avoid large fines, and maintain trust with customers and regulatory authorities.

4. Simplify Documentation and Data Processing

AI simplifies document and data processing in the financial sector. Traditional methods of handling paperwork and data are time-consuming and prone to human error. AI-driven solutions, such as optical character recognition (OCR) and natural language processing (NLP), can efficiently extract and process data from various documents, including loan applications, contracts, and financial statements.

For example, AI can quickly scan and interpret mortgage applications, validating the information and ensuring compliance with regulatory standards. This reduces the processing time and minimizes errors, leading to faster and more accurate decision-making. Additionally, AI can analyze historical data to identify patterns and trends, providing valuable insights for future business strategies.

5. Track Transactions in Real Time

Data security in the banking and finance sector is crucial due to the sensitive nature of customer information. With the abundance of publicly available data and rising fraudulent activities, protecting usernames, passwords, and security questions has become increasingly difficult for organizations. The future may shift away from traditional security methods like passwords, usernames, and security questions toward more seamless and effective fraud prevention techniques.

Leading FinTech companies are gradually moving from traditional SQL databases to blockchain technology, which offers a more secure platform for storing sensitive information. Machine learning applications are set to elevate security in the finance sector through voice and face recognition, along with other biometric data. This approach enhances security, customer retention, and satisfaction by providing a secure and seamless authentication process.

Companies such as Adyen, Payoneer, and Stripe have invested heavily in machine learning-based security and are actively working towards this shift. From a more technical perspective, banking algorithms employ Natural Language Processing (NLP) to supervise the amounts of emails and other information entering their systems. These algorithms use supervised machine learning techniques like support vector machines (SVM) and random forest trees to detect patterns that may indicate malicious behavior or any customer information leakage.

6. Get Personalized Recommendations

AI-powered personalized recommendations improve customer experience by offering customized financial advice and product proposals. The personalized recommendations are enabled by machine learning algorithms that analyze data on clients, including transactional history, spending habits, and financial goals.

For instance, AI can suggest investment opportunities based on a client’s risk tolerance and objectives. Using AI technologies, robot advisors recommend offering customers tailored investment plans and providing continuous monitoring and adjustments. Thus, the degree of personalization helps clients to make informed choices relating to finance, hence leading them closer to the achievement of financial objectives.

7. Analyze Market Trends

AI analyzes massive amounts of market data in search of patterns and predictions. This could be done by real-time processing using machine learning models that collect data from stock markets, economic indicators, or news articles to identify emerging trends.

AI is used by financial institutions worldwide for predictive analytics that help with forward-looking decisions built on facts instead of intuition. For example, through historical data analysis alongside market sentiment reviews, artificial intelligence algorithms predict future movements in stock prices.

Based on these insights, traders/investment managers can thus optimize trading strategies for better returns. Moreover, global economic indicators and geopolitical events can be monitored through AI, giving a comprehensive overview of the market dynamics within which banks operate, increasing certainty around strategic planning processes, reducing risks, and ensuring better client outcomes.

SEE: Finance Cost Optimization with AI Solutions

Supercharge Your Financial Services with AI!

Explore innovative AI use cases in finance to optimize decision-making, improve customer experiences, and boost efficiency. Let ViitorCloud’s AI experts craft solutions tailored to your needs.

How does ViitorCloud Reshape Finance Operations With AI?

AI is revolutionizing the finance sector, offering transformative solutions that enhance every aspect of financial operations. With advanced AI use cases in finance, such as fraud detection, risk management, personalized financial recommendations, and market trend analysis, businesses are empowered to improve efficiency, accuracy, and customer experience. As AI continues to evolve, financial institutions must stay ahead of the curve by embracing innovative AI finance solutions that drive competitiveness and operational success.

At ViitorCloud, we specialize in providing cutting-edge AI finance solutions tailored to your business needs. Our team delivers customized AI development services that go beyond the basics, offering sophisticated tools like AI-powered chatbots, video analytics solutions, and intelligent AI assistance. By integrating these AI-driven tools into your financial ecosystem, you’ll achieve seamless operational improvements, streamline decision-making, and unlock the full potential of AI solutions for maximum ROI.

Choosing us as your AI partner means tapping into our expertise and proven track record in transforming financial operations. Whether you’re looking to enhance risk management, personalize customer experiences, or optimize your market analysis, our AI-driven strategies ensure your business remains competitive in an ever-evolving landscape. Let us help you stay ahead by implementing AI finance solutions that truly make a difference.

Partner with us today and take your financial operations to the next level with our world-class AI solutions. Maximize your growth, streamline your processes, and secure a future of innovation. Also, reach out to us on LinkedIn and we will help you to achieve your business goals faster than ever!

Frequently Asked Questions

AI has disrupted finance by improving its efficiency, fostering risk management, allowing personalized customer service, and automating routine tasks. It leads to cost savings, better decision-making, and increased customer satisfaction.

AI may be used in finance for fraud detection, credit scoring, personalized financial advice, algorithmic trading, and process automation among others. This enables it to analyze data sets giving insights into predicting trends or optimization of financial operations.

JPMorgan Chase uses artificial intelligence to manage regulatory compliance among other areas. The company’s artificial intelligence platform saves its legal teams 360000 hours annually through automation of document review as well as compliance processes related to regulations applicable within the lending divisions of JPMorgan Chase bank amongst others.