Machine Learning and AI for revolution of Tech Companies are changing and streamlining businesses.

In the finance sector, achieving efficiency and reducing costs are more necessary than ever. ViitorCloud’s AI solutions are designed to help your business unlock new levels of productivity and profitability. With our cutting-edge AI development services, we help finance organizations streamline operations, optimize costs, and make data-driven decisions with excellent accuracy.

AI finance cost optimization is not just about automating repetitive tasks. We use advanced AI techniques like Generative AI to transform your financial processes. These solutions delve deep into your data, uncovering valuable insights, forecasting trends, and making intelligent recommendations that enhance decision-making. Whether it’s identifying patterns in large datasets or predicting future market behaviors, our AI solutions work tirelessly to maximize your financial outcomes.

With finance cost optimization with AI solutions from us, businesses can reduce operational costs, increase efficiency, and stay ahead of the competition. Our AI experts team developed AI tools that are designed to evolve with your needs, ensuring that as your business grows, so do the benefits of your AI infrastructure. We take pride in offering customizable AI finance solutions that can adapt to your unique challenges and goals.

With ViitorCloud, you’re not just adopting AI; you’re investing in the future of your financial success. Our finance cost optimization with AI services is tailored to ensure you see tangible results, from cost reduction to improved strategic decision-making. Let us help you turn AI potential into real-world performance.

Revolutionize your finance operations! In the following blog, discover how our AI development services can drive your business forward with AI solutions specifically crafted for the finance sector. Let’s unlock the future of finance together!

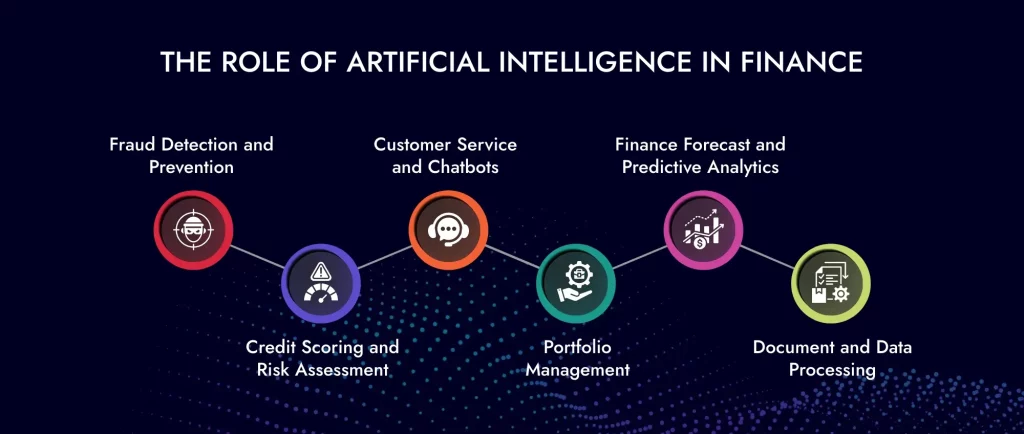

The Role of Artificial Intelligence in Finance

ViitorCloud provides innovative AI solutions that can greatly improve the operational capabilities of financial institutions, helping them better serve their clients. We offer tailored AI development services designed specifically for the finance sector, leveraging advanced technologies. Effective finance cost optimization with AI solutions is essential for staying ahead. Our expertise in AI finance cost optimization enables financial organizations to streamline their processes, reduce operational costs, and enhance overall efficiency.

Let’s have a look at how finance cost optimization with AI works and the role of AI in finance:

1. Fraud Detection and Prevention

The banking and investment sectors continually deal with fraud on a daily basis, one of them being money laundering. Financial institutions have traditionally used expert-written rules coded into software. Though efficient, criminals often avoid these rules. By creating an artificial intelligence system that “learns” to identify suspicious behavior without fixed rules, we have AI.

Machine learning is used by about 70% of financial organizations for fraud detection. Besides detecting fraud, AI-powered chatbots act as a first line of defense during digital transactions, verifying identities with advanced techniques like biometric analysis or multi-factor authentication (2FA).

These virtual assistants handle tasks usually done by human agents, such as identity verification, and answer queries 24/7 without fatigue or bias. It also leads to improved customer service quality and reduced operational costs.

2. Credit Scoring and Risk Assessment

Fintech firms are already leveraging machine learning’s abilities to exploit information not usually tapped into by traditional financial companies. Rather than sticking with basic credit data, they access alternative sources such as online activities, social media content, or smartphone usage patterns. This advanced analysis paints a more detailed picture of an individual’s financial habits, helping lenders manage risks more effectively and possibly offering borrowers lower interest rates.

A Wells Fargo study highlighted that AI implementation resulted in fewer loan defaults than conventional methods used by major financial corporations. Besides aiding decisions on asset allocation, AI plays a crucial role in efficiently managing investment risks. It does this by analyzing complex datasets from different sources like economic indicators and social media sentiments, identifying possible threats before they cause significant impacts on portfolio performance.

Fintech organizations utilize advanced ML algorithms to forecast future trends based on past behavior patterns and anomalies uncovered during analysis. Thus, proactive risk mitigation strategies can be employed instead of reactive measures taken after incurred losses.

3. Customer Service and Chatbots

AI-powered chatbots are now indispensable when it comes to automating customer service processes. These virtual assistants use machine learning algorithms to improve continuously based on user interactions. Beyond handling queries 24/7, these chatbots provide tailored financial advice by analyzing an individual’s financial data and patterns and suggesting better-saving strategies or suitable investment opportunities.

Another strong application of AI in fintech is that predictive analytics helps predict future behaviors based on past trends and customer feedback, thus allowing companies to anticipate solutions even before clients express needs. Major corporations like Wells Fargo use this technology to predict possible issues affecting their customers’ accounts or transactions, thus enabling them to act promptly and fostering trust between the institution and its clientele within the finance and banking industry.

4. Portfolio Management

AI and machine learning algorithms are now critical for improving decision-making processes and optimizing investment portfolios towards maximum returns with minimum risk.

It is also vital in assessing the performance of an investment portfolio and asset allocation. Today’s Fintech companies use AI instead of traditional methods, which rely on financial advisors using past data and personal experience.

This innovative method allows for a flexible asset allocation, which changes investments depending on market conditions instead of sticking to a particular strategy. This way, it enhances returns while effectively reducing risks.

5. Finance Forecast and Predictive Analytics

Predictive analytics is a crucial tool in the fintech world. It applies statistical techniques such as modeling and machine learning to analyze facts plus historical information. Therefore, this kind of deep analysis makes it possible to forecast future events or behaviors within the finance sector accurately. These technologies enable financial institutions to have factual insights rather than relying on speculation or gut feelings, leading to better outcomes.

Many advantages accrue to fintech firms that integrate AI into their systems. One is improved operational efficiencies; automated systems can perform complex calculations much faster than humans, driving traditional financial services to such technological advancements.

Also, AI is essential in predicting future happenings based on previous and current data. This attribute is vital to financial achievement, such as saving for personal assets or increasing a company’s profitability while cutting expenditures.

6. Document and Data Processing

Artificial intelligence in document and data processing has transformed the finance industry. In the past, dealing with large amounts of financial information and paperwork used to take time and was usually prone to mistakes. Conversely, AI automates this operation by automating it, avoiding errors due to human involvement.

AI-powered tools can quickly extract, categorize, and analyze data from different documents, such as invoices, contracts, and financial statements, to aid in faster processing time, lower error risk, and higher data accuracy. To this end, machine learning algorithms improve their performance over time by gaining knowledge of new data, consequently boosting their ability to identify trends and abnormalities.

For instance, AI can automate extracting relevant information from a large volume of unstructured data that converts into structured formats that are easier to analyze and report. For compliance purposes in particular, where accurate and timely reporting is important the capability is helpful.

READ: AI in Finance – Transforming Banking with AI Solutions

Optimize Your Financial Operations with AI!

Discover how our AI solutions drive finance cost optimization and boost efficiency in the BFSI sector. Let’s transform your business now!

Finance Cost Optimization with AI Solutions

AI plays an important role in driving finance cost optimization with AI solutions. These advancements not only lead to reduced costs but also significantly enhance the efficiency of financial activities.

By implementing AI finance cost optimization, organizations can streamline their processes, allowing finance teams to focus on strategic initiatives rather than routine tasks. This shift fosters a more agile and responsive financial environment, ultimately resulting in better decision-making and improved overall performance. Embracing these innovations is a confident step toward a more efficient future in finance.

Let’s discuss how finance cost optimization with AI solutions works:

1. AI-Powered 24/7 Customer Support – Chatbots

The majority of consumers believe that customer service is crucial for brand loyalty. Time and resource constraints can frustrate customers and mar their experience. Many customers expect banks to provide 24/7 customer service, regardless of time zones. However, difficulties associated with 24-hour service include hiring, training, and scheduling staff. These challenges require significant financial investment, thus consuming much of banks’ budgets.

This is where AI chatbots come in handy, helping with any task at any given time. One of the major benefits of finance cost optimization with AI is an expansion of access to self-service for customers; however, they must be able to understand instructions delivered via texts or sound prompts generated by an interactive voice response (IVR) system. Chatbots can interpret context, detect emotion in text messages, and respond appropriately.

Chatbots are best suited for determining account balances or knowing fixed deposit rates. Millions are saved by these artificial intelligence bots, freeing up resources and saving time for the banking industry. Additionally, chatbots overcome language barriers since training them involves teaching them how to answer queries and converse using any language.

2. Automation of Routine Tasks

Finance cost reduction may be achieved by automating routine tasks as part of an artificial intelligence integration strategy, with machines taking over such tasks as entering information into databases, making transactions go through, or verifying whether regulations have been complied with, which used to be done manually, taking much time.

Thanks to powerful AI systems that can do these operations with high precision and speed, human involvement may be minimized. This, in turn, will save labor costs and minimize the chances of making costly mistakes.

For example, AI can do account reconciliation automatically, while payroll management, invoice processing, etc., become much simpler. These developments, therefore, mean that finance cost optimization with AI is a reality all over the world.

3. Resource Optimization

By providing actionable insights through advanced data analytics, AI helps financial institutions to optimize resources within their reach. For instance, using artificial intelligence makes it possible to detect inefficiencies from huge amounts of information available to understand market trends and make better decisions about investing for the future. Financial institutions must use their assets efficiently by allocating them properly among capital equipment, employees, and technology.

For instance, predictive analytics based on AI can anticipate customer behaviors hence helping financial companies know where they should put more money into or remove such services – this approach is known as strategic resource allocation. Through this method, desired results are achieved at the minimum costs possible.

4. Operations Efficiency

AI simplifies processes and reduces time taken in executing complex tasks thus enhancing operational efficiency for an organization. Such measures can be implemented by using artificial intelligence in workflow management hence optimizing customer service especially when it comes down to decision-making processes for financial-related issues.

The AI integration strategy of chatbots into an organization’s operations ensures that customers have access to support every day of the week including weekends even during odd hours of the night. Therefore this results in improved satisfaction levels among clients who no longer have to wait in long queues at any banking hall looking for someone capable enough answering even simple queries made by text messages or through pressing buttons on their phones; thus saving millions each year on maintaining large call center teams only ready assist you 24/7.

Additionally, real-time fraud detection is more efficient than conventional techniques because it allows monitoring and analysis of actual transactions carried out by AI-powered cost reduction in finance. To prevent further damage from fraud and protect the institution’s reputation, this proactive approach to fighting fraud saves money by reducing losses associated with fraudulent activities.

5. Automated Receipt and Invoice Tasks

According to a study conducted by Harvard Business Review Analytic Services, 67% of C-suite executives agree that their teams’ major activities include chasing receipts and invoices. Again, 64% think that financial departments should concentrate on examining financial information to guide business decisions. This gap shows how vital strategic obligations differ from regular operational roles.

With built-in automation, AI provides real-time data and simplifies the month-end close process. AI solution automates chasing missing receipts and invoice information, saving you time, improving accuracy, and speeding up spend visibility without constantly asking colleagues for information.

ALSO READ: Benefits of AI in Finance: Transforming Financial Services

Cut Costs and Enhance Efficiency with AI Solutions

Leverage the power of AI for finance cost optimization and unlock unparalleled operational efficiency. Partner with ViitorCloud today!

Examples of Successful Enterprises in the Finance Industry

AI applications in finance, ranging from credit scoring to fraud detection, have maintained efficiency and accuracy. Industry reports reveal that nearly 70% of financial institutions use machine learning for essential functions like risk management and customer service automation. This adoption improves decision-making processes and optimizes operational costs, paving the way for significant financial gains.

Moreover, AI’s impact extends beyond operational efficiency to economic contribution. Forecasts indicate that AI could inject $15.7 trillion into the global economy by 2030, exceeding the combined current outputs of China and India. This economic windfall highlights AI’s pivotal role in driving global growth and competitiveness across financial enterprises. In parallel, regional insights highlight India’s burgeoning AI market, projected to reach $3.9 billion by 2028, fueled by rapid digitization and AI’s transformative capabilities in the banking, healthcare, and telecommunications sectors.

Innovative AI tools like ChatGPT exemplify AI technologies’ rapid adoption and scale within financial enterprises. With ChatGPT collecting over 100 million active users within months of its launch, the application highlights AI’s potential to improve customer interaction and operational productivity. Enterprises are using ChatGPT to enhance customer service, generate multilingual content, and improve workforce productivity. As financial institutions continue to use AI’s capabilities, they are on the way to unlock new opportunities for growth, efficiency, and customer satisfaction.

SEE: Top Applications of AI in Finance Transforming the Industry

Transform Finance with Smart AI Solutions

Our AI expertise helps you achieve finance cost optimization while improving performance in the financial sector. Get started with us!

How Can ViitorCloud Help Finance Companies with AI Solutions?

In the finance industry, staying ahead of the competition means adopting innovation—and AI is at the forefront of that transformation. From finance cost optimization with AI solutions to streamlining routine tasks, AI is revolutionizing how financial institutions operate. It’s not just about reducing costs; it’s about creating new efficiencies, optimizing investment decisions, and delivering superior customer service. For companies that are serious about AI finance cost optimization, now is the time to adopt AI solutions that can future-proof your operations and drive business growth.

AI development companies like us understand the unique challenges faced by financial institutions. That’s why our AI development services are designed specifically to meet your needs. Whether you’re aiming to cut costs, enhance operational efficiency, or explore AI-driven insights for better decision-making, we offer AI solutions that will empower your business to succeed in this growing market. Our team of AI experts works closely with you to deliver customized solutions that align with your goals, ensuring a seamless integration of AI into your financial operations.

Why wait? The future of finance is AI-driven, and ViitorCloud is here to help you harness that potential. From automating back-office tasks to implementing refined algorithms for financial analysis, our AI finance cost optimization solutions are built to deliver results. Contact us today and let us lead the way in transforming your finance operations with innovative AI technologies.

Don’t miss the opportunity to stay competitive! Partner with ViitorCloud and unlock the true power of AI for your business.

Frequently Asked Questions

AI automates routine tasks, enhances operational efficiency, and minimizes errors, reducing overhead costs significantly.

AI optimizes finance by enhancing decision-making with predictive analytics, improving risk management, and automating processes for faster transactions.

AI simplifies workflows, speeds up data processing, and enables faster customer service through automation and predictive insights.