Artificial Intelligence is already transforming industries, and finance is no exception. While blockchain, cryptocurrencies, and Robo-advisors often make headlines, AI is the true game-changer in the finance sector. The future of finance lies in smart, AI-powered solutions that drive efficiency, enhance customer experiences, and reduce operational costs.

The financial services are vast and complex, from retail banking and investment management to insurance and accounting. This is where our AI development services step in. Our AI solutions streamline processes, improve decision-making, and cut costs, empowering your business to stay ahead in a competitive market.

The applications of AI in finance are extensive, whether it’s fraud detection, personalized banking experiences, or automated investment strategies. AI simplifies operations and enables your team to focus on growth, not just maintenance.

If you want to elevate your business with AI, ViitorCloud is here to help. Our expertise in AI development ensures that your finance operations will not only be more efficient but also future-proof. We provide tailored AI solutions that can transform your financial services!

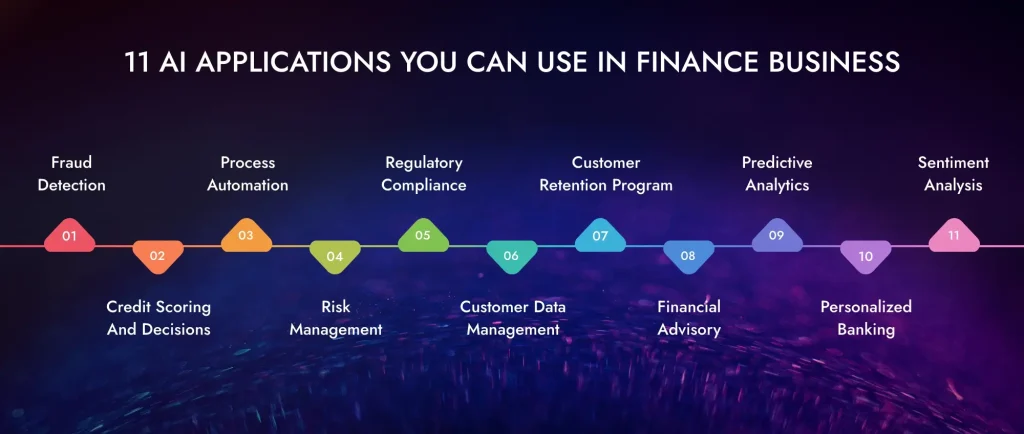

Top 11 Applications of AI in Finance Business

By integrating AI into finance, companies can significantly reduce operational costs and increase profit margins. This technological advancement also grants customers the convenience of accessing their accounts on their smartphones, allowing for seamless mobile banking experiences.

1. Fraud Detection

AI has become an integral tool for detecting and preventing frauds, especially within Fintech due to its ability to analyze large amounts of data quickly and accurately.

Machine learning algorithms are crucial for improving how financial institutions detect fraud. AI applications in finance algorithms learn from past financial transactions to spot patterns that may indicate fraudulent behavior. This predictive analytics approach helps companies proactively identify threats before they cause damage, offering extra protection for customers’ private data.

Also, Artificial Intelligence-powered chatbots serve as gatekeepers during digital transactions. Scammers use these as their first defense through methods like biometric analysis or multi-factor authentication (2FA) that verify the identity of individuals who could be thieves. Such technology keeps malicious people away from innocent customers.

2. Credit Scoring and Decisions

Credit scoring has been transformed by Artificial Intelligence (AI) in financial services where traditional models have been replaced with more accurate and sophisticated ones. For instance today, fintech firms use AI-driven machine learning algorithms that consider more variables than traditional financial institutions do.

These algorithms make use of both standard credit data along non-traditional sources such as online behavior, social media interactions, or even phone usage patterns. This is because AI in finance applications gives lenders a better view concerning borrowers’ reliability in terms of finances other than just relying on regular credit data only which means they can assess risk better leading to lower interest rates.

According to a Wells Fargo study based on fewer loan defaults following the adoption of artificial intelligence than conventional methods applicable among major financial institutions, it is evident that AI effectively enhances risk management within the finance industry.

3. Process Automation

Machine learning solutions enable financial services companies to automate repetitive tasks thus increasing productivity through intelligent process automation. Examples of such innovations include chatbots, automated paperwork handling, and gamified employee training. The result – enhanced customer experience, reduced costs, and improved service scalability.

Furthermore, machine learning technology is also effective in accessing and interpreting data to identify patterns and trends. In this regard, AI in finance application chatbots are used by customer support systems to deal with a wide range of issues as if they were real people.

For example, Wells Fargo has a chatbot on Facebook Messenger driven by machine learning that interacts with users seamlessly helping them find account information or recover passwords; this illustrates how artificial intelligence can improve customer service in the banking sector.

4. Risk Management

Banks and other financial institutions can use machine learning techniques that analyze huge amounts of data to reduce risk factors greatly. Thus, unlike traditional methods, which only consider limited details like credit scores, ML appraisals better understand an individual’s personal information, which is widely available for assessing their real risk capacity.

Machine learning-based insights into banking and financial services simplify informed decision-making. For instance, ML programs may draw from multiple data sources while assessing loan applications before giving them risk scores. This way, the algorithms will give possible defaulters, prompting companies to adjust terms or rethink their approach towards each client individually.

READ: Benefits of AI in Finance: Transforming Financial Services

5. Regulatory Compliance

Keeping pace with regulatory changes across different locations constitutes a challenge to Fintech companies. This is made easier with constant monitoring and interpretation of new rules by Artificial intelligence in finance application. It updates the system’s rules on time for compliance purposes, reducing the chances of penalties and improving trust between customers and regulators alike.

6. Customer Data Management

Regarding banks and financial institutions, data is crucial for their operations and success. Efficiently managing volumes of diverse financial data—from mobile communications and social media activity to transaction details and market data—is a significant challenge even for financial experts.

By using machine learning approaches, organizations can increase processes’ efficiency and capacity to get valuable information from data. Among these AI and ML tools are analytics, data mining, and natural language processing that help derive actionable Intelligence from this huge number of records, which essentially enhances business profit.

For example, customer financial data can be evaluated by machine learning algorithms to assess the influence of market changes and specific financial trends. This enables institutions to make informed decisions and offer customized services that cater to customer requirements in a better way.

7. Customer Retention Program

ML technology used by credit card companies determines which customers are in danger of becoming dormant and works on retaining them proactively. Their system helps them accurately forecast the behavior of their customers based on user demographics and transaction history and adaptively create custom-made offers.

During this operation, predictive models are used to spot at-risk customers using binary classification. In turn, the recommender model provides personalized card offers for effective customer retention from dropping off.

8. Financial Advisory

Machine learning-driven budget management apps provide customers with specialized financial advice and guidance. These apps enable users to track daily spending and analyze data to pinpoint spending patterns and areas for potential savings.

Another emerging trend is the rise of Robo-advisors. These AI-powered tools work like human advisors but target individuals and small and medium-sized enterprises with limited resources. Robo-advisors use machine-learning algorithms to build investment portfolios advising on trading, investments, or retirement issues among other needs.

9. Predictive Analytics

In Fintech companies predictive analytics is an important thing to consider. It uses methodologies like modeling, and machine learning to enable deep analysis of both present and historical datasets. This kind of analysis makes it easier to predict events happening in the future or behaviors taking place in the finance sector more precisely.

Factual insights rather than speculation or intuition are obtained by financial institutions using these beneficial technologies. Hence, more informed decision-making is possible leading to better overall outcomes. Various advantages come with Fintech firms integrating AI capabilities within their systems.

One such benefit is increased operational efficiency; traditional financial service providers prefer this technology since automated systems perform complex calculations much faster than humans. Moreover, AI enhances risk management strategies particularly in hedge funds and asset management firms by enabling more sophisticated risk assessment mechanisms and mitigation measures.

10. Personalized Banking

Financial advice does not fit all because its unique circumstances differ from each client’s. In this way, AI helps financial institutions provide personalized guidance and “advice engines” that use machine learning to suggest customized investment decisions, taxation, insurance, etc.

Similarly, AI adaptive capabilities go beyond simple automation providing highly targeted advice on the other hand.

11. Sentiment Analysis

Through using advanced AI systems Fintech companies are now able to handle amounts of data from social media posts and news articles. By using machine learning algorithms, these systems can understand an investor’s sentiment towards a specific security or the entire market and differentiate between positive, negative, and neutral sentiments.

AI uses NLP for interpreting human language. It mainly focuses on identifying emotional words in text data and assigning scores based on positivity or negativity. NLP analyzes sentiment in text data for personalized financial services provided by Fintech platforms.

For example, when algorithmic trading approaches discover similar investors demonstrating increased optimism around certain stocks algorithmic trading methods like this sentiment analysis can be used as a signal toward investing some of your money into them.

Enhance Financial Performance with AI

Use AI applications in finance to drive efficiency and innovation. Our expert AI development services deliver customized solutions to meet your unique needs.

What is the Potential of AI to Reduce Finance Costs

AI, especially Generative AI powered by Large Language Models (LLMs), is transforming the finance industry by automating tasks, increasing efficiency, and significantly reducing manual work. Financial companies can stay updated and enhance customer experiences by using these disruptive technologies with tailored AI solutions from ViitorCloud.

By investing in AI development services, businesses can implement AI applications quickly and see immediate benefits. For example, AI can streamline coding processes, helping developers launch new financial products and services faster and with greater accuracy. Imagine reducing your operational costs while boosting performance—AI makes this possible.

A recent global survey revealed that 36% of financial professionals reported cost reductions of over 10% after integrating AI. According to the study, several hundred Nvidia’s financial customers have been found implementing them. Nearly half saw noticeable improvements in customer service. At ViitorCloud, we offer AI-driven solutions that not only enhance customer interactions with multilingual support but also streamline compliance, risk management, and security efforts—drastically lowering costs in these areas.

ViitorCloud has already helped numerous businesses harness the applications of AI in finance, such as contract translations and seamless communication between diverse teams and customers. Our AI development services are designed to reduce costs, improve service, and transform financial operations.

Transform Your Financial Strategy with AI

Stay ahead in the finance sector by incorporating advanced AI applications. Our top-notch AI development services provide comprehensive solutions to enhance your financial processes.

How ViitorCloud Empowers Finance to Become Future-Ready

The finance industry is undergoing a rapid transformation with the integration of AI. Applications of AI in finance are driving efficiency, enhancing customer experiences, and improving decision-making. AI processes large volumes of data with remarkable speed and precision, enabling financial institutions to operate more efficiently while offering personalized services tailored to each customer’s needs.

At ViitorCloud, we empower financial institutions to become future-ready with our cutting-edge AI solutions. Our AI development services are designed to help your organization adapt to the evolving finance sector, improving compliance, optimizing financial strategies, and elevating customer service.

Hire AI developers and transform your finance operations with AI! Partner with ViitorCloud today and lead the way to a smarter, more efficient future. Contact us now to explore how our AI solutions can revolutionize your business.

Frequently Asked Questions

Applications of AI in finance offer enhanced decision-making, risk management, and personalized services. It improves efficiency by automating routine tasks, analyzing many data sets for insights, and providing predictive analytics for better financial planning.

AI in finance examples include AI-driven chatbots for customer support, fraud detection systems, robot advisors for investment advice, credit scoring models, and automated compliance monitoring that streamline operations and improve service delivery.

AI in finance application solutions includes predictive analytics; machine learning algorithms used in spotting fraudulent activities; financial advisor personalization technologies; automatic compliance systems as well and customer interaction tools powered by artificial intelligence that boost efficiency and customer experience.

Vishal Patel

Vishal Patel is an experienced Solution Consultant with a proven track record in the information technology and services industry.