Machine Learning and AI for revolution of Tech Companies are changing and streamlining businesses.

The world of finance is transforming with a drastic shift, driven by the integration of blockchain technology into financial technology, or fintech.

Blockchain, known for its connection with cryptocurrencies like Bitcoin, is proving to be a game-changer for the financial industry.

With Fintech Blockchain Solutions data becomes nearly tamper-proof, and safeguards sensitive information from fraud and manipulation.

It doesn’t matter if you’re a financial professional, an entrepreneur, a technology enthusiast, or simply curious about the collaboration of blockchain and fintech, this blog will guide you into understanding the future of finance.

Benefits of fintech blockchain solutions

At its core, blockchain is a distributed ledger technology that records transactions across a network of computers in a secure, transparent, and tamper-resistant manner.

In the fintech landscape, blockchain ensures data security and integrity in financial transactions, which eventually reduces the risk of fraud and errors.

With blockchain, fintech companies can build a foundation of trust that is fundamental to the finance industry.

Empowering security and trust:

Blockchain eliminates the need for intermediaries, putting users in direct control of their transactions.

It prevents unauthorized access and manipulation of financial data, ultimately fostering trust among users.

Transparency

Every transaction on a blockchain is recorded in a public ledger that is accessible to all participants in the network.

This transparency builds trust and confidence among users, as they can independently verify the integrity of transactions.

Smart contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code.

They automate various financial processes, such as insurance claims, loan approvals, and trade settlements, reducing the need for intermediaries and the associated costs.

Auditability

The immutability of blockchain records makes audits more straightforward and trustworthy. Regulators and auditors can easily trace transactions and verify compliance with financial regulations.

Reduced fraud

Blockchain’s security features and transparency make it a less appealing target for fraudsters.

It becomes more challenging for bad actors to manipulate or alter financial records.

Financial inclusion

Blockchain technology can help extend financial services to underserved populations around the world.

By providing access to banking and payment services through mobile devices, it can bridge the financial inclusion gap.

Cost efficiency and reduction

Blockchain’s ability to eliminate intermediaries has significant cost-saving implications for both fintech companies and customers.

Companies can reduce operational costs, and customers benefit from lower transaction fees.

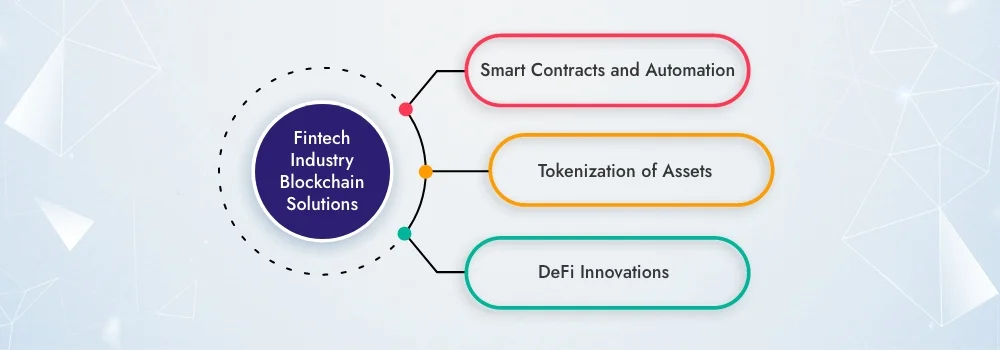

Fintech industry blockchain solutions

Fintech Industry Blockchain solutions are the driving force behind the fintech sector’s transformation, promising to make financial transactions more secure, efficient, and accessible than ever before.

This new way of financial services is unlocking new possibilities for financial inclusion and accessibility on a global scale. These fintech blockchain solutions are defining the future of finance.

Smart contracts and automation

Smart contracts have the terms of contracts directly written into code which makes them self-executing agreements.

In fintech, smart contracts automate financial agreements and transactions, reducing the need for intermediaries. They ensure efficiency and accuracy, as code is the law.

Real-life examples explain how smart contracts are changing fintech applications by simplifying complex processes.

Tokenization of assets

Asset tokenization involves converting ownership rights of physical assets into digital tokens on a blockchain.

This innovation allows fractional ownership, making assets more accessible and tradable. Real estate and stock tokenization examples showcase how this benefits investors and fintech companies alike.

Decentralized finance (DeFi) innovations

Decentralized finance (DeFi) is disrupting traditional financial services.

DeFi platforms offer decentralized lending, borrowing, and exchanges, democratizing access to financial services.

This innovation empowers individuals worldwide, eliminating barriers and intermediaries in finance.

Fintech’s efficiency with blockchain

Blockchain’s decentralized and immutable ledger system has proven to be a game-changer in streamlining financial operations.

The incorporation of blockchain technology in fintech is revolutionizing the way financial operations are conducted, offering a future where financial transactions are secure and also significantly more efficient.

Streamlining cross-border payments

Cross-border payments have long been marred by inefficiencies in traditional systems.

Blockchain resolves these challenges by enabling fast, secure, and cost-effective international transactions.

Cryptocurrencies and stablecoins play a significant role in this transformation, offering alternatives to traditional currencies.

Enhanced transparency and traceability

Blockchain’s transparency ensures real-time access to transaction histories for customers.

This transparency is particularly valuable in supply chain finance, trade finance, and fintech applications. It facilitates trust and accountability, reducing the risk of disputes and fraud.

Fintech’s transparency via blockchain

In the world of financial technology (fintech), transparency is a fundamental necessity. Blockchain technology emerges as a focal point in ensuring this transparency.

Fintech’s Transparency via Blockchain is paving the way for a more reliable, secure, and user-centric future in finance.

Building trust through transparency

Blockchain’s transparent nature fosters trust between fintech companies and their clients.

Case studies underscore how transparent financial operations positively impact customer satisfaction and loyalty.

When customers can independently verify transactions and data, trust naturally follows.

Financial inclusion and accessibility

Blockchain technology has the power to promote financial inclusion by providing banking services to the unbanked and underbanked populations.

Real-world examples of fintech blockchain solutions showcase how individuals worldwide gain access to financial services and opportunities previously out of reach.

Conclusion

The integration of blockchain consulting services into fintech is nothing short of a revolution. Fintech Blockchain Solutions empower security, trust, cost efficiency, and transparency.

Embrace Fintech’s Blockchain Revolution, and be a part of the future of finance, where transparency and efficiency reign supreme.

Contact ViitorCloud today to be a part in the Fintech’s Blockchain Revolutionary journey.

Frequently asked questions

What is blockchain in fintech?

Blockchain can be used to record transactions in a secure and temper-proof way. Blockchain is a distributed ledger technology.

How is blockchain used in fintech?

It is being used in fintech in a variety of ways, including Payments, Remittances, Asset management, and Identity management.

How does blockchain improve the efficiency of fintech businesses?

Blockchain improves the efficiency of fintech businesses by reducing costs, improving security, and increasing transparency.

What is the future of blockchain in the fintech industry?

The future of blockchain in the fintech industry is very bright. Blockchain for fintech has the potential to revolutionize the way financial services are delivered.